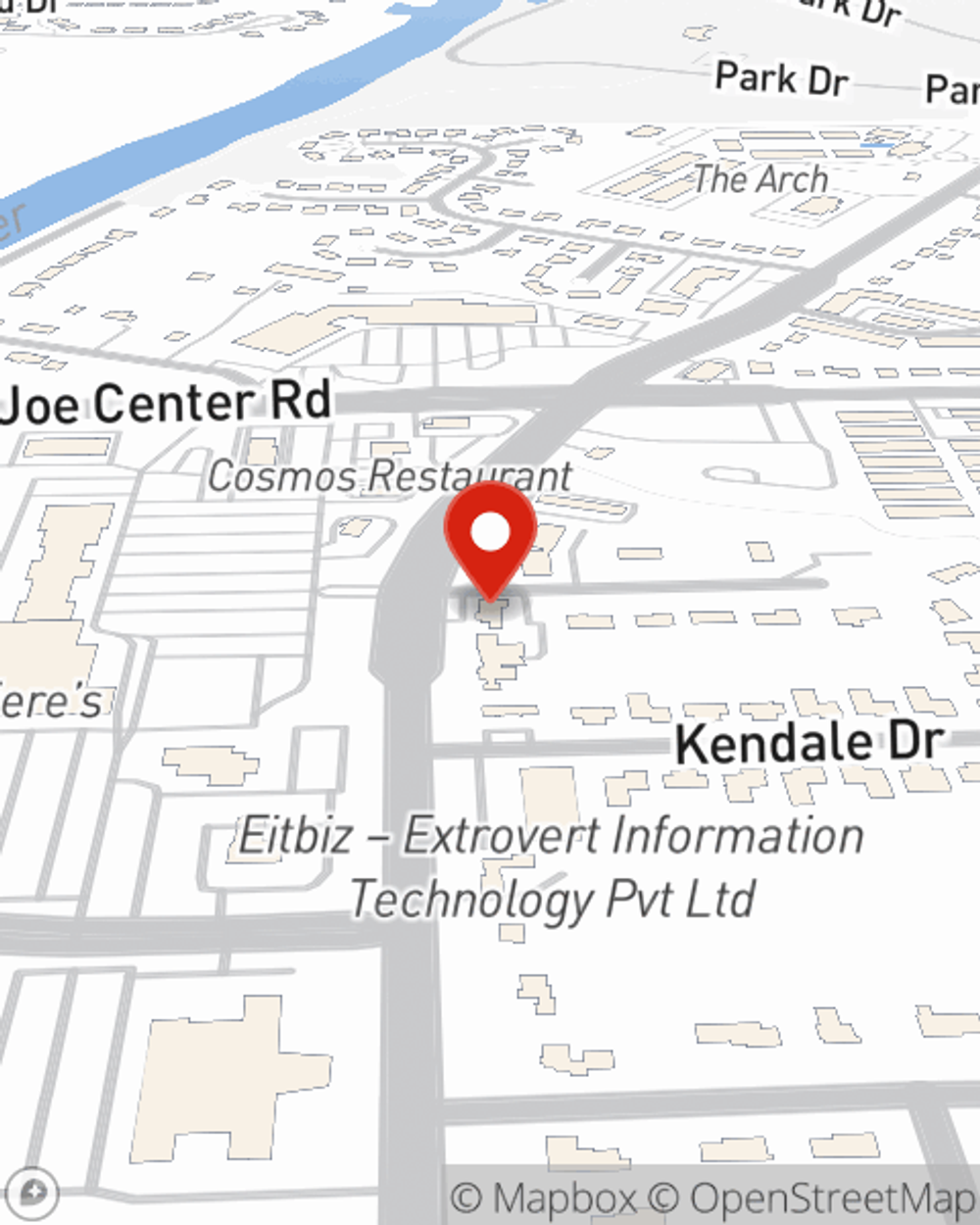

Business Insurance in and around Fort Wayne

Fort Wayne! Look no further for small business insurance.

Cover all the bases for your small business

- Fort Wayne

- New Haven

- Huntertown

- Waynedale

- Maples

- Huntington

- Antwerp

- Hicksville

- Logtown

- Garrett

- Auburn

- Churubusco

- Columbia City

- Bluffton

- Decatur

- Angola

- Allen County

- Dekalb County

- Huntington County

- Stueben County

- Whitley County

- Monroe County

- Lenawee County

- Hillsdale County

State Farm Understands Small Businesses.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes catastrophes like a staff member getting hurt can happen on your business's property.

Fort Wayne! Look no further for small business insurance.

Cover all the bases for your small business

Protect Your Future With State Farm

Protecting your business from these possible accidents is as easy as choosing State Farm. With this small business insurance, agent Terry Anderson can not only help you design a policy that will fit your needs, but can also help you submit a claim should an accident like this arise.

Take the next step of preparation and contact State Farm agent Terry Anderson's team. They're happy to help you investigate the options that may be right for you and your small business!

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Terry Anderson

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.